Updated on: October 7, 2024 12:38 pm GMT

Understanding Broadcom’s Impact on the Semiconductor Market

In recent years, the semiconductor industry has been in the spotlight, particularly due to the explosive growth in demand for artificial intelligence (AI) technologies. As one of the leading players in this space, Broadcom has created waves that ripple through the market, influencing everything from the prices of chips to the performance of competing companies. If you’re wondering how Broadcom’s success intertwines with the broader semiconductor market and investment opportunities, you’re in the right place.

From its significant revenue growth in AI chips to the strong positioning of companies like Marvell Technology, let’s explore what Broadcom’s journey means for investors and the future of chip stocks.

An Overview of Broadcom

Founded in 1993, Broadcom has quickly evolved into a powerhouse in the semiconductor landscape. With a market capitalization soaring from around $230 billion to over $700 billion, it stands as one of the world’s most valuable firms, ranked 11th overall and third among chipmakers, trailing only Nvidia and TSMC. Broadcom’s ascendance has been primarily fueled by its dominance in application-specific integrated circuits (ASICs), holding an estimated market share of 55% to 60%.

Strong Performance in AI Chips

One of the most compelling aspects of Broadcom’s recent trajectory is its impressive growth in AI-related revenue. Over the past year, shares of Broadcom surged by 82%, a testament to its robust performance in the custom AI chip sector. As noted by JPMorgan analyst Harlan Sur, Broadcom has established itself as the second-most critical player in the AI chip market, a designation that speaks volumes about its strategic positioning amid increasing competition.

Broadcom reported a massive jump in its data center revenue, which is crucial for sustaining its growth. This growth is not only helping boost the company’s bottom line but also enhancing its valuation, which now stands at a notable 17 times sales and a staggering 70 times trailing earnings. While such high valuations might deter some investors, understanding the underlying dynamics of the AI chip market is essential for grasping why Broadcom remains a solid investment choice.

The Challenge of High Valuation

Despite its impressive growth, Broadcom’s high valuation raises some eyebrows among investors. The question arises: is the stock too expensive, or does its potential growth justify the premium? While experiencing striking growth, potential investors may find themselves tempted to explore alternative options that present less financial risk.

Investing Alternatives: Marvell Technology

If Broadcom appears to be priced out of reach for some investors, then alternatives like Marvell Technology are worth considering. Marvell, the second-largest player in the ASIC market with a 15% share, is leveraging the AI chip boom to carve out its niche in the semiconductor space.

Marvell’s Recent Performance

Marvell recently announced its fiscal 2025 second-quarter results, which reflected challenges faced due to a slight revenue decline. However, what truly caught investors’ attention was Marvell’s data center revenue, which skyrocketed by 92% compared to the prior year, contributing significantly to its overall earnings. The fact that data center chips now account for 69% of Marvell’s topline adds further weight to its potential growth story.

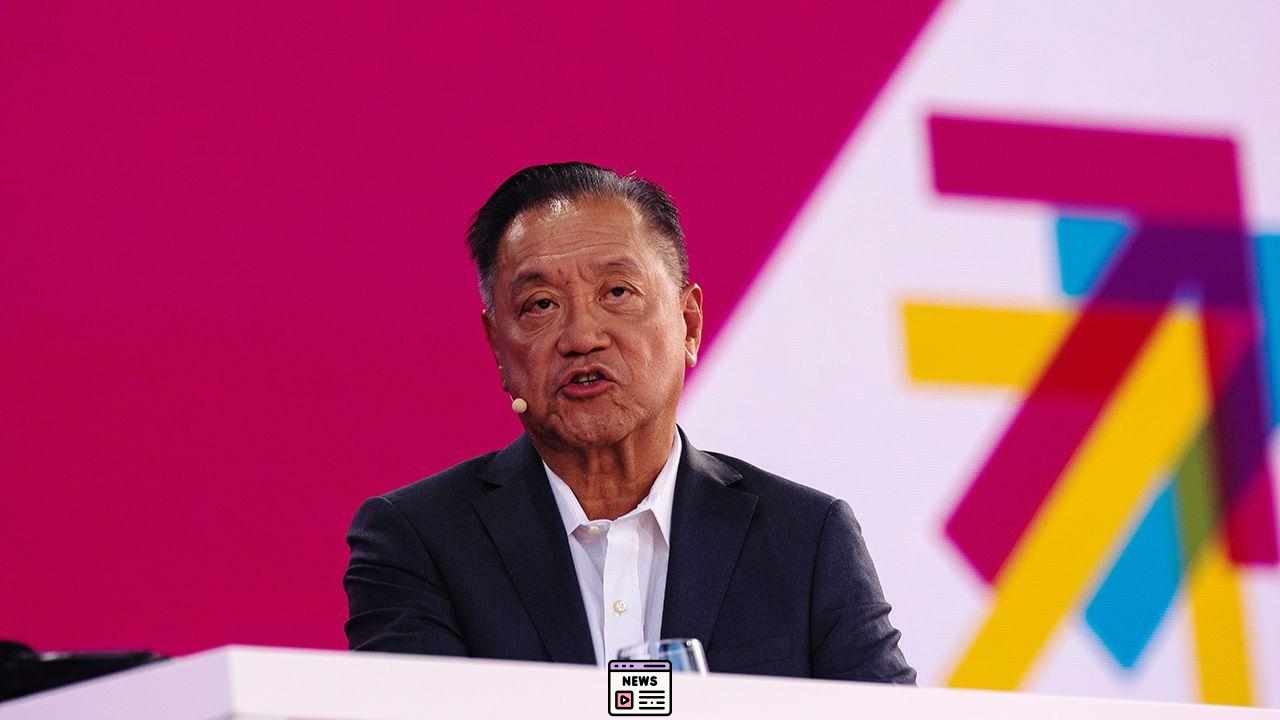

CEO Matthew Murphy gave bullish guidance for the future, indicating that Marvell’s custom AI silicon programs are progressing well, with production ramp-ups expected to accelerate revenue growth. Furthermore, Wall Street is optimistic, with analysts predicting Marvell will exceed its forecast of $1.5 billion in AI-related revenue, further solidifying its reputation as a formidable player in this competitive space.

The Future of Custom AI Chips

The custom AI chip market is projected to be a significant revenue driver in the coming years, with JPMorgan analysts estimating a cumulative opportunity of around $150 billion over the next four to five years. This places both Broadcom and Marvell in prime positions to capitalize on the expected growth.

Market Dynamics and Price Ratios

When considering investment options, price-to-sales and forward earnings ratios can provide valuable insights into a company’s valuation and potential for growth. Broadcom’s high valuation is certainly a point of concern; however, Marvell’s comparatively lower price-to-sales ratio of 12.5 and forward earnings multiple of 30 makes it an attractive alternative for investors looking for shares with greater growth potential at a lower price.

What Lies Ahead for Chip Stocks?

As AI continues to dominate discussions in tech and investment circles, chipmakers like Broadcom and Marvell will play crucial roles in shaping the landscape. Both companies are well-positioned to benefit from the increasing reliance on AI technology in various sectors, from cloud computing to consumer electronics.

Investor Considerations

– **Risk Tolerance:** High valuations indicate potential risks, and understanding your risk profile is essential before investing.

– **Market Trends:** Stay informed about market trends, particularly in AI and semiconductor industries, as these areas will dictate future growth.

– **Diversification:** Keeping a diverse portfolio can provide cushion against volatile market changes, so consider spreading investments across different companies.

Conclusion

Broadcom’s incredible leap from a lesser-known entity to a $700 billion behemoth in the semiconductor industry exemplifies the power of innovation and opportunity in the tech landscape. While the appeal of investing in high-performing stocks like Broadcom is undeniable, alternatives like Marvell Technology are proving to be worthy contenders.

As a potential investor, maintaining awareness of these dynamics and remaining agile to market changes can help you navigate the semiconductor stock landscape more effectively. The growth of AI chips heralds tremendous opportunities, and with careful consideration, your investment choices could yield impressive returns for years to come.

Investing wisely means looking at the big picture and noticing the trends that affect the market. By doing this, you can make better choices for your money and feel more confident on your financial journey.