Updated on: October 14, 2024 3:24 pm GMT

As investment banks grapple with the escalating poaching practices of private equity firms, JPMorgan Chase’s CEO Jamie Dimon is taking a firm stance. His recent comments have ignited discussions around ethics and career decisions for aspiring bankers. Dimon believes that young professionals should be given a fair chance to explore their options without undue pressure from competing firms.

Dimon’s Discontent with Private Equity Practices

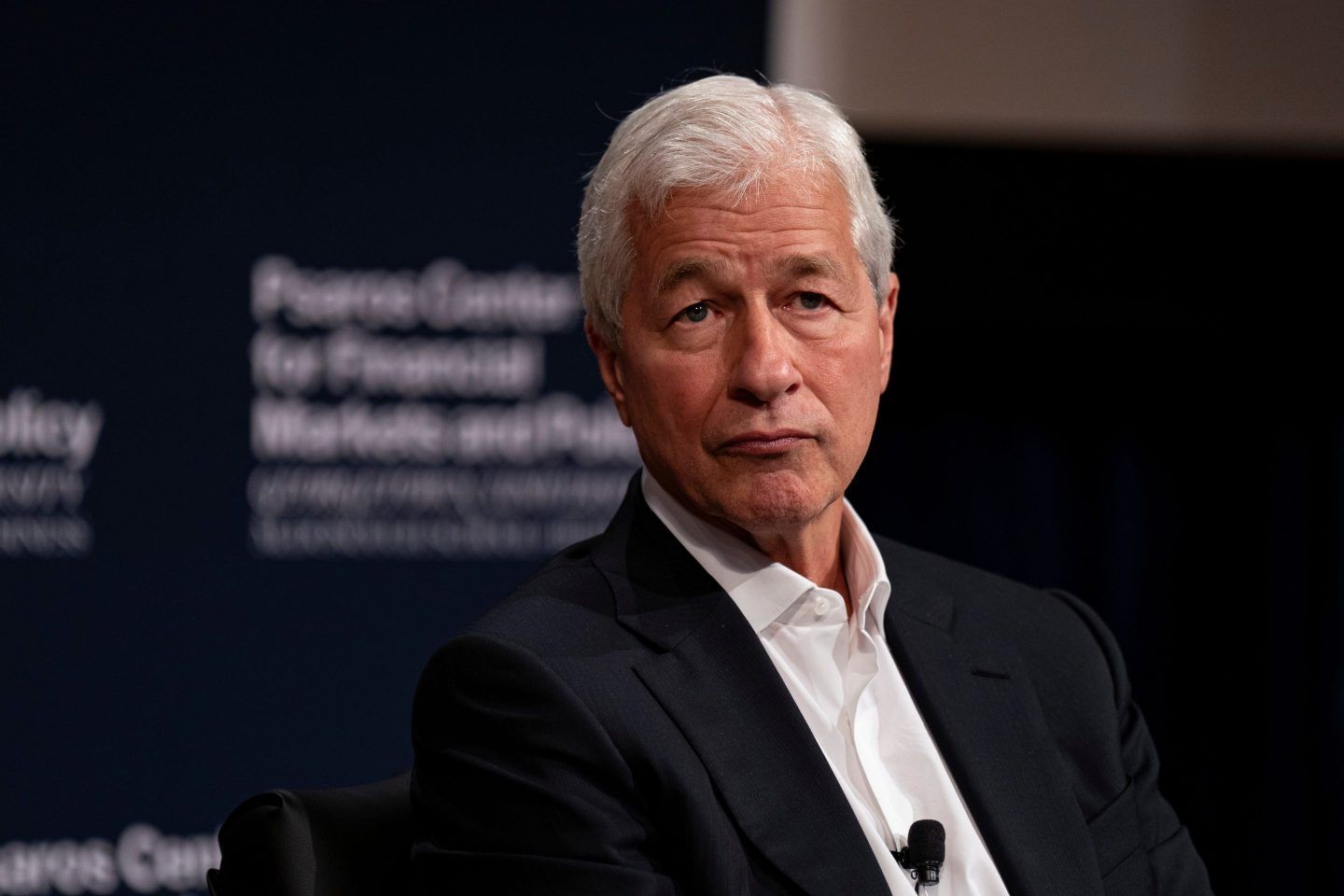

During a recent talk at Georgetown University’s Psaros Center for Financial Markets and Policy, Dimon openly criticized the trend of private equity firms recruiting inexperienced bankers even before they start their roles at investment banks. He stated, “I think that’s unethical,” expressing concern over how this practice affects new graduates navigating their early careers.

- The practice of securing future positions in private equity often occurs before recruits have even begun their roles at banks like JPMorgan.

- Dimon emphasized the ethical implications of these decisions, noting that many young people are put in difficult positions due to the pressure from fluctuating job offers.

JPMorgan has noted that this recruitment trend has accelerated significantly, with firms acting earlier than ever to capture talent, sometimes even before graduation.

The Ethical Dilemma for Young Professionals

In his address, Dimon highlighted the risks that come with accepting private equity positions too early. He pointed out that many new bankers handle sensitive information at JPMorgan, creating potential conflicts of interest if they take another position before their current job even starts. “It puts us in a bad position,” Dimon said, underlining his apprehension about the ramifications for both the bank and the young professionals involved.

This sentiment struck a chord with the audience, prompting a mix of laughter and serious reflection on the implications of such decisions. The conversation quickly shifted from a light-hearted remark to a serious dialogue about ethics in the competitive financial sector.

Pushback and Proposals for Change

Dimon did not mince words when considering potential changes to how JPMorgan handles such recruiting issues. He stated, “I may eliminate it, regardless of what the private equity guys say.” His proposed solutions included creating policies that would institute clearer guidelines for how banks and firms interact with newly hired bankers.

Moreover, Reena Aggarwal, the founding director of the Psaros Center, noted that banks have also been moving their recruitment timelines earlier, leading to an escalating race for talent. She suggested that there might be an opportunity for collaboration between schools and banks to establish better hiring protocols.

The Hiring Landscape and Its Impact on Junior Bankers

As the boundaries continue to blur between investment banks and private equity firms, emerging bankers face unique challenges. The intense interviewing process to snag a placement in private equity begins before many even start working, leaving them in tough ethical dilemmas regarding loyalty and career trajectory.

- Confidentiality Risks: Accepting an early commitment may compromise the confidentiality agreements many junior bankers are bound to.

- Pressure and Choice: Dimon stressed the importance for young professionals to carefully consider their choices, urging them to reflect on how they’d like to be treated in similar situations.

If you are interested, more insights can be found here.

The Future of Investment Banking Recruitment

The conversation around recruitment strategies is crucial as firms navigate new expectations and market demands. Dimon’s candid critique of private equity firms reflects broader concerns in the industry regarding talent retention and ethical standards.

If these trends continue, future junior bankers may find themselves on uncertain ground, with heightened competition altering the landscape before they’ve even begun their careers. “You’re going to be facing ethical decisions like that,” Dimon remarked, emphasizing that the power to choose lies ultimately with the young professionals entering the industry.

As the dialogue moves forward, both banks and private equity firms may need to adapt their strategies to foster a more sustainable working environment for everyone involved. By considering the ethical implications of their recruiting practices, financial firms can help empower the next generation of bankers to make informed choices about their careers.

Dimon’s pushback might be a big change for how the finance industry thinks about hiring practices. This shift is important for both companies and young workers, as they need to carefully find their way in this changing environment.