Updated on: October 8, 2024 9:40 am GMT

The U.S. economy reported a mixed picture for August, adding 142,000 jobs as the unemployment rate fell to 4.2%. These findings, released by the Bureau of Labor Statistics on Friday, suggest hiring in the labor market has cooled, although it is not as severe as some forecasts had predicted.

Labor Market Overview

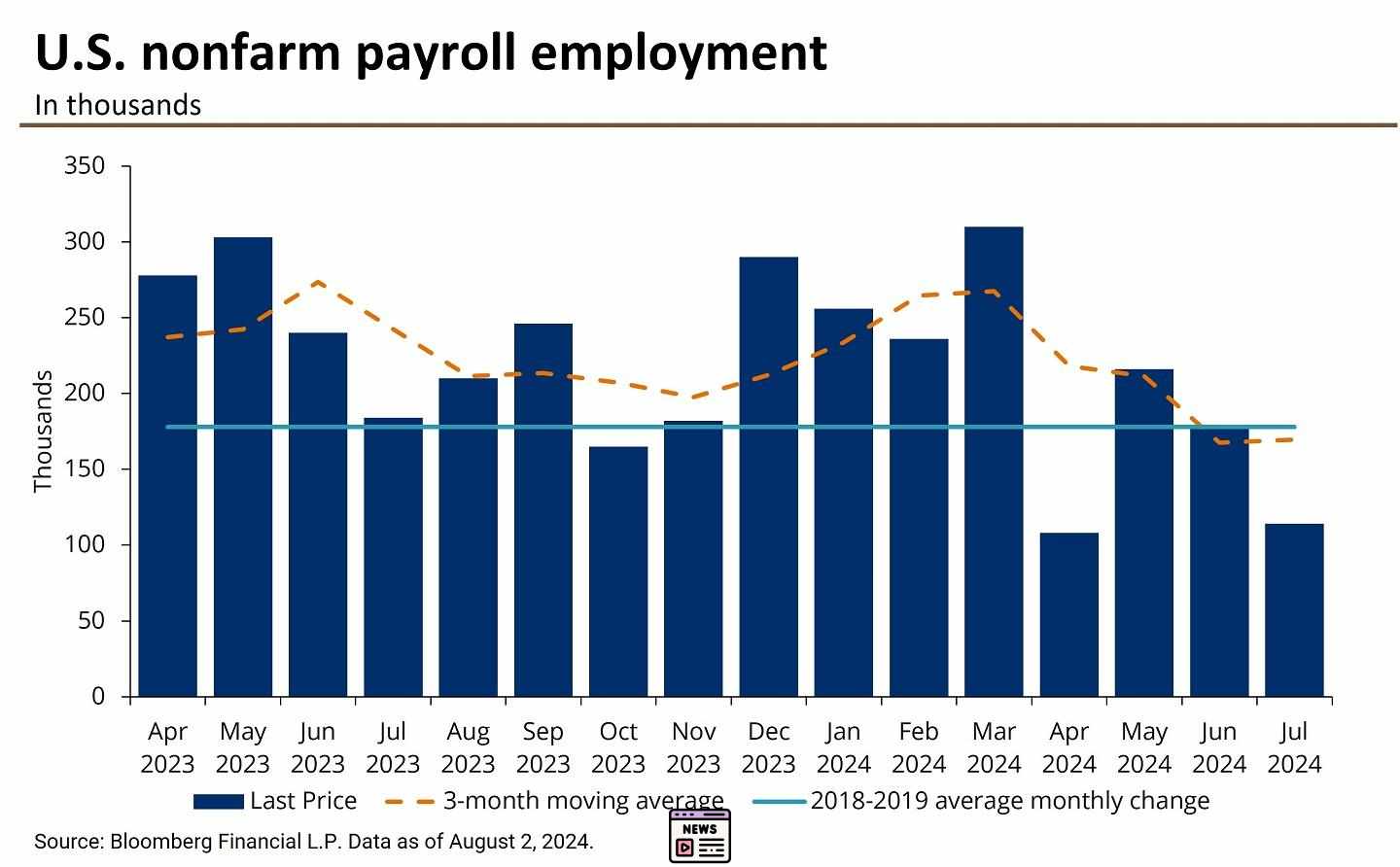

The latest jobs report reveals that the economy’s job additions fell short of economists’ expectations. Analysts had anticipated an increase of approximately 165,000 jobs. Despite this shortfall, the unemployment rate showed improvement, dropping from 4.3% in July. The report indicates that hiring, while increasing compared to July’s revised figure of 89,000 jobs added, reflects a notable slowdown in the overall pace of additions when compared to the averages seen earlier in the year.

Sector-Specific Job Growth

A deeper analysis of the job gains indicates that employment growth was concentrated in specific sectors. Notably, hospitality accounted for 34,000 jobs, healthcare contributed 31,000 jobs, and the construction sector saw a similar increase with another 34,000 jobs added. Conversely, sectors such as manufacturing and retail experienced job losses, which adds to concerns regarding the resilience of the labor market.

Wage Growth and Inflation Dynamics

Wage growth continues to be a point of focus and concern as it relates to inflation. In August, average wages rose 3.8% year-over-year, an increase from the 3.6% reported in July. Month-over-month wage growth also increased by 0.4%, indicating that worker earnings are moving ahead of inflationary pressures, which is a positive sign for consumer purchasing power. This trend provides some relief amidst a backdrop of rising prices in previous months, although future inflation reports will clarify ongoing trends.

Implications for Federal Reserve Policy

This mixed jobs report arrives at a critical time for the Federal Reserve, which is set to convene for its next policy meeting on September 17-18. The central bank’s leadership, including Chair Jerome Powell, has hinted at potential interest rate cuts in light of the recent cooling in the labor market. However, the extent of any cuts remains undetermined.

- Comparative job growth has decelerated; the gains for August are approximately 30% lower than the average monthly additions over the last year.

- Revised figures for prior months indicate an addition of 86,000 fewer jobs than initially reported for June and July combined.

- The downward revision aligns with other data showing a decline in job openings across the market.

Economists continue to debate the appropriate response. Some analysts advocate for a cautious approach, suggesting that the solid job gains and reduced unemployment could justify a modest 25-basis-point cut in rates. Others argue that the downtrend in job additions necessitates a more aggressive response, possibly a more substantial 50-basis-point reduction.

Market Reactions

Market responses reflect the ambiguity of the jobs report. Stock indexes experienced declines, as investors perceived the results as insufficiently strong. Current market speculation suggests a 45% chance of a 50-basis-point reduction by the end of the Fed’s upcoming meeting, a rise from 30% just a week prior. Market confidence appears tentative as stakeholders absorb the implications of the latest data.

Economic Context and Future Prospects

The August jobs report highlights ongoing challenges in the economic landscape, including a labor market that is showing signs of strain. While it is reassuring that the unemployment rate has decreased, the overall pace of hiring suggests that the economy may not be as robust as previously thought. Continuous monitoring of economic trends will remain essential as policymakers navigate the complex terrain of inflation, employment, and interest rates.

The job market is holding up pretty well, but this new report shows that we need to keep paying attention to what’s happening. The Federal Reserve is trying to decide what to do next with money policies as the economy keeps changing.