Updated on: October 9, 2024 7:08 am GMT

Wilbur Ross Outbids Warren Buffett: A Look Inside a High-Stakes Bankruptcy Battle

In the fierce arena of business acquisitions, few stories are as fascinating as the intense competition between seasoned investors Wilbur Ross and Warren Buffett. Ross recently recounted a defining moment in his career involving the once-iconic Burlington Mills, which ultimately filed for bankruptcy in 2001, burdened with over $800 million in debts. This high-stakes confrontation not only showcases Ross’s strategic prowess but also highlights the contrasting bidding tactics employed by two of the investment industry’s titans.

The Fall of Burlington Mills

Burlington Mills, an established name in American textile manufacturing founded in 1923, was once a powerhouse that employed approximately 8,000 workers. However, the rise of foreign competition, particularly from Asian countries, led to its significant decline. The company, along with J.P. Stevens, faced insurmountable challenges that resulted in a Chapter 11 bankruptcy filing. With unsecured bonds plummeting and a mountain of unfunded pension liabilities, Burlington became a prime target for savvy investors.

Preparing for Battle

As the chairman of the unsecured creditors committee, Ross prepared to bid on the company, believing that he could turn around its fortunes. Both Ross and Buffett recognized the potential value in acquiring Burlington, but their strategies diverged dramatically. Ross and his fellow bondholders decided to bid using at-par bonds, a strategy that Buffett challenged in bankruptcy court, arguing that cash should take precedence over defaulted bonds.

During this intricate legal proceeding, Ross was put under cross-examination by Buffett’s attorney, who questioned the wisdom of choosing equity over cash. However, Ross maintained that since the unsecured creditors were risking their investments, the court should honor their preference for stock. Ultimately, the judge agreed, validating the creditors’ choice and allowing Ross’s bid to proceed.

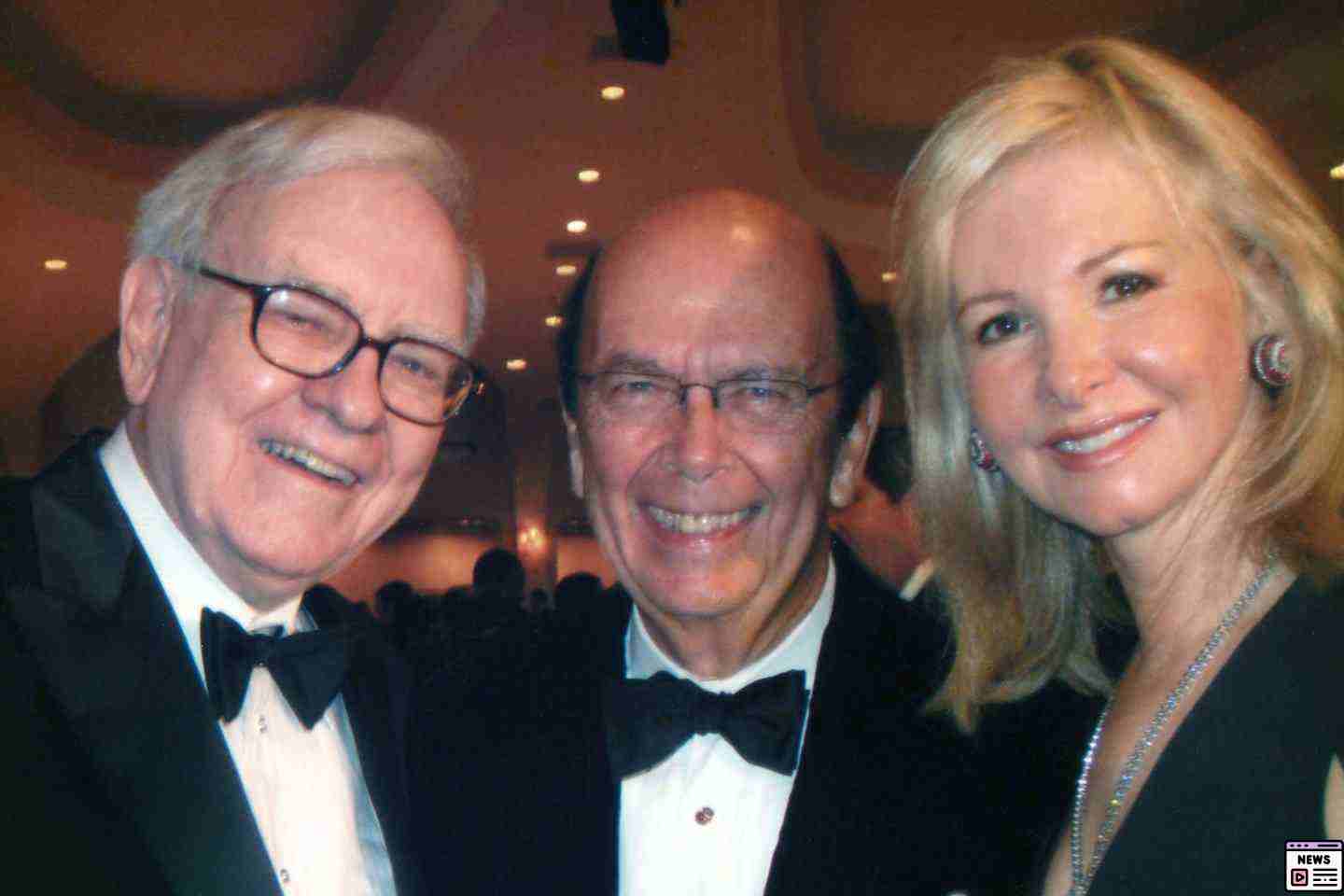

!Wilbur Ross and Warren Buffett share a light moment at a public event.

The Aftermath of Competition

In a surprising twist, Ross’s victory in acquiring Burlington did not sour his relationship with Buffett. The two encountered each other again at a public event, where they shared a humorous moment reminiscing about their bidding war. Buffett, known for his good-natured demeanor, joked about the experience and reassured Ross that his wallet contained only a modest sum.

Transforming Burlington into International Textile Group

Following the acquisition, Ross devised a reorganization plan to save Burlington from its financial troubles. Central to this plan was the sale of its most profitable unit, a carpet manufacturing segment, which he successfully sold to Mohawk Industries for an impressive $352 million. The proceeds would help mitigate the company’s overwhelming liabilities, particularly its pension obligations.

Ross’s strategy involved trading the defaulted bonds for complete equity in the restructured company. The judge approved this approach, paving the way for the creation of International Textile Group (ITG), which would later merge with additional assets acquired by Ross.

Navigating Global Ventures: A Mixed Bag

To ensure profitability, Ross sought to expand ITG’s reach through international partnerships. He launched joint ventures in Mexico, China, and Vietnam. However, the venture in Vietnam proved disastrous due to reliance on a state-run partner, resulting in substantial financial losses. Ross acknowledged this misstep, noting the challenges of navigating business in environments rife with inefficiencies and corruption.

Legacy and Lessons Learned

Wilbur Ross’s experiences with Burlington Mills and investment strategies against Warren Buffett exemplify the complexities of the business world. From courtroom battles to international expansions, Ross’s narrative illustrates a career marked by resilience and strategic thinking. His insights offer valuable lessons for aspiring entrepreneurs navigating similar challenges.

For more on Ross’s journey and insights into investment strategies, you can explore resources like Fortune for in-depth articles and analysis.

This story shows how Wilbur Ross’s legacy is still alive. It gives us a glimpse into the tough competition and the complex situations that happen in big business deals.