Updated on: October 10, 2024 3:42 pm GMT

European Central Bank Cuts Interest Rates Amid Cooling Inflation

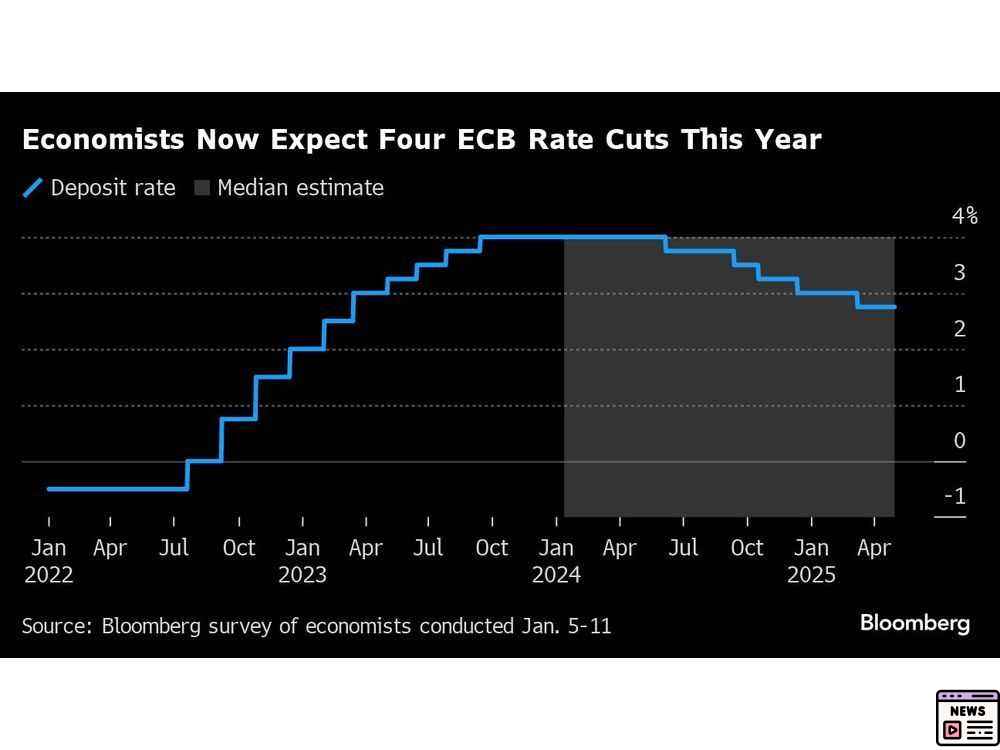

On Thursday, September 14, 2023, the European Central Bank (ECB) announced a quarter-point cut in interest rates, reducing the deposit rate from 3.75% to 3.5%. This significant decision comes after a period of slow economic growth and easing inflation rates across the euro zone, now moving closer to the ECB’s target of 2% inflation. The move marks the second interest rate reduction this year and sets the stage for future monetary policy discussions as the ECB continues to navigate a complex economic landscape.

The Current Economic Climate

Inflation Meets Policy Shifts

Consumers and businesses alike have felt the impact of the ECB’s previous decisions, with interest rates affecting everything from loans to mortgages. Inflation, which peaked in the past year, has started to cool down, prompting a reconsideration of aggressive monetary policies that characterized much of the last few years. Economists are now examining the implications of the ECB’s latest rate cut on economic conditions across member states.

Market Reactions

Following the announcement, market analysts observed a slight rise in the euro against the U.S. dollar, which traded around $1.102 shortly after the decision. European stock indices, such as the Stoxx 600, also displayed positive momentum, climbing by 1.1% as investors expressed renewed confidence ahead of the announcement.

Looking Ahead: What’s Next for the ECB?

Upcoming Meetings and Predictions

The ECB will reconvene on October 17, and economists are divided on whether further rate cuts will follow. Some predict another 25 basis point cut in December, while others urge caution, citing fluctuating inflation rates and economic growth concerns. The upcoming meetings are expected to focus heavily on economic data, which will undoubtedly influence the ECB’s decisions.

Comments from ECB Officials

In her upcoming press conference, ECB President Christine Lagarde will likely address the prevailing economic challenges and clarify future policy directions. Economists suggest that Lagarde may emphasize a data-driven approach, underscoring the importance of monitoring economic indicators closely in the months ahead.

Potential Challenges Ahead

The ECB faces difficult choices as it balances the need for economic stimulus against inflation risks. The ongoing tension between a tight labor market and growing costs of living remains a focal point for many economists. Some experts warn that while the recent rate cuts may stimulate growth, any unexpected data trends could complicate the decision-making process for the ECB.

Global Context: The Federal Reserve’s Moves

Comparisons with the U.S. Federal Reserve

The timing of the ECB’s rate cut coincides with indications that the U.S. Federal Reserve is also preparing to reduce rates in its upcoming meetings. Economists speculate that the Fed’s actions could influence the ECB’s strategy, as policymakers grapple with similar inflationary pressures and economic conditions.

Investor Sentiment

Broadly, many investors are optimistic about the ECB’s path forward, anticipating that further reductions may facilitate economic recovery in the euro area. Analysts are monitoring signals from both the ECB and the Fed for clues about future market conditions, especially in light of increased volatility and uncertainty through the fall and winter months.

Conclusion

The European Central Bank’s latest interest rate cut is a crucial step in addressing inflation and boosting economic growth across Eurozone countries. As Lagarde prepares to address reporters after the meeting, all eyes will be on the central bank’s forecasts and guidance for future policy moves. Investors and economists alike will continue to scrutinize the situation, eager to discern the implications for the broader economic landscape.

Recent Economic Indicators and their Impact

Monitoring Economic Trends

In the months leading up to the ECB’s meeting, economic indicators such as employment rates, consumer spending, and international trade have shown mixed signals. Many analysts suggest that a closer examination of these trends will be critical in shaping future ECB policy. The need for adaptive and responsive economic strategies cannot be understated, especially as global economic conditions remain precarious.

The Balance of Risk

The European Central Bank (ECB) has a tough job right now. They need to be careful about lowering interest rates so that it doesn’t make inflation worse. At the same time, they want to help the economy grow. If they can manage these tricky issues, it might lead to a more stable economy in the Eurozone, which would be great news for families and businesses.