Updated on: October 7, 2024 6:31 pm GMT

Introduction

In the turbulent sea of stock markets, few companies manage to weather the storm and thrive. One such company is Godfrey Phillips India Ltd, which has recently become a hot topic among investors and market analysts alike. With its shares soaring to record highs despite broader market corrections, the company’s performance has raised several eyebrows. Have you ever wondered what drives a stock to unprecedented heights? Whether you’re a seasoned investor or just dipping your toes into the market, understanding the factors behind Godfrey Phillips’ recent success could offer valuable insights.

This article will delve deeply into the reasons behind the remarkable surge in Godfrey Phillips’ share prices, including the impending 2:1 bonus share issue and the implications for investors. So, grab a cup of your favorite beverage, and let’s explore the thrilling world of stock trading through the lens of this remarkable company.

The Surge in Godfrey Phillips’ Stock Prices

Market Performance Amidst Corrections

As of late September 2024, Godfrey Phillips India Ltd has shown impressive resilience. On a day when domestic benchmarks faced considerable corrections, the shares rose by an astonishing 14.19%, reaching an all-time high of Rs 7,300. This surge came on the heels of an announcement from the company’s board regarding a meeting scheduled for September 20 to consider a bonus issue of shares at a 2:1 ratio. It appears that the promise of additional shares has fired up investor interest.

But what does this all mean? When a company’s stock price climbs sharply in a time of market corrections, it hints at strong fundamentals, or at the very least, speculative optimism from investors. In Godfrey Phillips’ case, both factors may be at play.

The 2:1 Bonus Share Issue

The announcement of the 2:1 bonus share issue is a key event that has significantly impacted investor sentiment. But what exactly is a bonus share issue? In simple terms, it rewards existing shareholders with additional shares without any cost—essentially free shares. For every share a shareholder owns, they will receive two additional shares if the board’s proposal is approved.

This approach rewards shareholder loyalty while also enhancing liquidity by increasing the number of shares available for trading. It’s important to note that bonus shares come from capitalizing the company’s reserves, which means this does not bring in extra cash flow but instead redistributes existing equity.

Understanding the Implications

While bonus shares might seem like a windfall, they can also affect stock valuation metrics. After the issuance, the total market capitalization of the company will remain unchanged, but the price per share is likely to adjust downward to reflect the increased number of shares. However, the overall value of an investor’s holdings will remain the same immediately after the bonus shares are issued.

Investors will need to be aware of the following factors to fully understand this impact:

- Liquidity: The increased number of shares can make it easier for investors to buy and sell stocks.

- Price Adjustment: Typically, after a bonus issue, share prices are recalibrated based on the new total number of shares.

- Dividend Rights: Bonus shares carry the same rights as existing shares, including eligibility for dividends.

Company Background: Godfrey Phillips India

Core Business and Operations

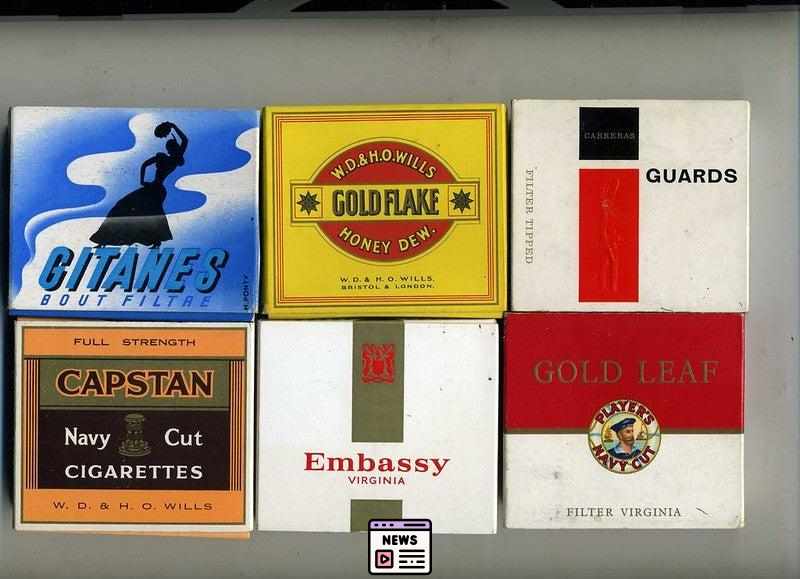

Godfrey Phillips India Ltd primarily operates in the manufacturing and trading sectors of cigarettes and tobacco products. However, the company does not stop there; it also has interests in the confectionery market and unmanufactured tobacco trading. The diversification of its business arms suggests a robust strategy to hedge against volatility in any one sector.

This multifaceted approach is vital, particularly in markets known for rapid change. By expanding into various divisions, Godfrey Phillips can balance the highs and lows characteristic of the tobacco and confectionery industries.

Recent Financial Performance

Despite the stock price surge, Godfrey Phillips has undergone mixed financial performance in its recent quarterly results. In the first quarter of 2024, the company’s net profit fell by nearly 11% to Rs 229 crore. Interestingly, revenue from operations rose by 16% year-on-year, indicating an increase in sales activity that may not have translated to higher profitability.

These mixed results can be critical for investors trying to gauge the overall health and sustainability of the company’s impressive stock performance. While growth in revenue is encouraging, a decline in profit may warrant close scrutiny and could suggest potential headwinds ahead.

Key Financial Metrics

To provide a clearer picture of the company’s valuation and investment potential, here are some essential financial metrics:

| Metric | Value |

|---|---|

| Market Capitalization | Rs 37,751.23 crore |

| Price-to-Earnings (P/E) Ratio | 41.01 |

| Price-to-Book (P/B) Ratio | 8.65 |

| Earnings Per Share (EPS) | 155.90 |

| Return on Equity (RoE) | 21.10% |

| Relative Strength Index (RSI) | 78.11 |

The P/E ratio suggests that investors are pricing in significant future growth, while the RoE reflects strong profitability relative to shareholders’ equity. However, the RSI value also indicates that the stock may be considered overbought.

Investor Sentiment and Market Reactions

Market Indicators and Trading Activity

The response from traders has been undeniably bullish, with shares exchanging hands at higher than average volumes—about 28,000 shares on a day when the two-week average was just 16,000. This amplified trading activity suggests that investor confidence is high, buoyed by the upcoming bonus share proposal and the stock’s remarkable price performance.

It’s also essential to note that the BSE and NSE have implemented long-term Additional Surveillance Measures (ASM) to monitor the stock due to its high volatility. While this could be perceived as a negative sign, it often serves to provide greater assurance for investors regarding the stock’s trading behavior.

Long-Term Investment Potential

Godfrey Phillips has more than doubled its stock value for investors over the past six months, and with a promising start to 2024, this rapid growth could signal a strong investment opportunity. However, prospective investors should not rush into decisions based solely on recent performance. Analyzing financial health, market conditions, and company strategies is critical before making any investment choice.

The addition of bonus shares could also attract retail investors, making the stock more accessible. As shares become more affordable due to the dilution of price, more investors may want to enter the market, possibly leading to further demand and, subsequently, further price increases—although this is never guaranteed.

Conclusion

Understanding the dynamics behind Godfrey Phillips India Ltd’s recent stock performance reveals an intriguing narrative about investor sentiment, company strategies, and market behavior. While the announcement of a 2:1 bonus share issue has undoubtedly sparked significant interest and activity in the stock, it’s essential for investors to consider the broader context, including recent financial performance and trading trends.

When you explore the world of stocks, it’s important to remember that big jumps in stock prices can be exciting, but doing your homework is really important. The stock market can change quickly, and knowing what’s going on will help you make smart choices. Whether the market is going up or down, understanding the basics of how it works will help you stay on track.