Updated on: October 7, 2024 2:24 am GMT

Understanding the Impact of Federal Reserve Rate Cuts on Gold Prices: Insights from Experts

Gold has long been considered a safe haven for investors, especially during periods of uncertainty. As economic indicators fluctuate and geopolitical tensions rise, the price of gold often sees a corresponding increase. With recent discussions from the Federal Reserve about potential interest rate cuts, many are left wondering how these changes might impact gold prices in the near term.

Over the past several years, September has proven to be a tough month for gold, with an average decline of 3.2%—making it the worst-performing month of the year. This statistic is concerning for investors keen on monitoring price trends and market movements. But why does September consistently bring challenges for gold, and how could new monetary policy changes shape the market in the coming months?

The Current Landscape: Gold’s Recent Performance

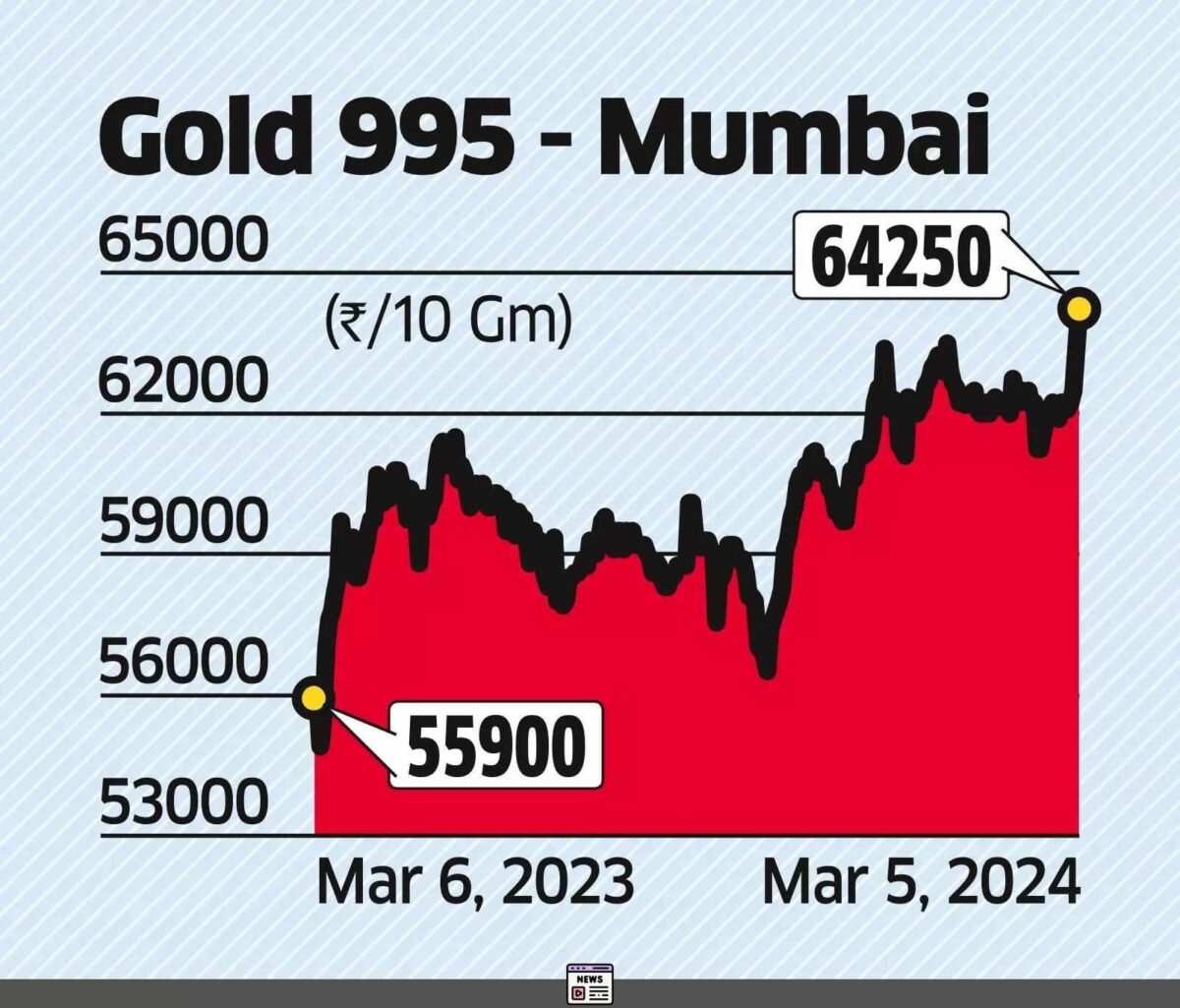

Gold prices have surged in 2023, showcasing a remarkable 22% increase so far. This upward trend can be attributed to several factors including strong central bank purchases, rising demand due to geopolitical tensions, and robust buying of physical bars in the market. The recent gains are underscored by market sentiment leaning toward the anticipation of Federal Reserve action.

Fed Chair Jerome Powell’s recent statements hinted that “the time has come” to reduce interest rates. The implications of this for gold prices can be profound. A potential rate cut—expected to be around 25 basis points—has already been factored into the current gold prices, particularly since the metal has recently been facing resistance in the $2,510-$2,520 range.

What’s Ahead? Predictions and Expert Opinions

Market analysts, like Jateen Trivedi, VP Research Analyst at LKP Securities, suggest that gold may remain in a trading range between $2,465 and $2,525 in the near term, owing to resistance levels and market volatility. He emphasizes that the trajectory of gold prices will largely depend on forthcoming economic data, including the Core PCE Price Index, inflation rates, non-farm payrolls, and unemployment figures.

Trivedi states, “Market participants will keenly monitor key data as the September policy meeting approaches.” This is crucial because any shifts in economic data could either reinforce or alter expectations for monetary policy, thereby impacting gold prices accordingly.

On the bright side, some experts are predicting a potential rally in gold prices if the Federal Reserve decides to cut rates more than what the market expects. Rahul Kalantri, VP Commodities at Mehta Equities, highlights the correlation between a looser monetary policy and gold prices, stating that a more dovish stance could lead to a weaker U.S. dollar and lower yields, both of which are supportive for gold.

Why Gold Might Shine Even Brighter

Gold’s appeal as a hedge against economic instability is a primary reason why investors turn to it. In uncertain times, when markets are volatile and currencies fluctuate, gold is often viewed as a stable asset. The anticipation of interest rate cuts can further inflate gold’s allure. As inflation rises or is expected to rise, many turn to gold as a safeguard against currency depreciation.

Additionally, should the Fed surprise the market with a 0.50 basis point cut, it would likely ignite a fresh rally in gold. A strong positive sentiment around gold prices can create a self-reinforcing cycle, leading to increased demand, which can, in turn, push prices higher.

Navigating Market Sentiments

Investor sentiment plays a pivotal role in the gold market. As mentioned earlier, expectations surrounding economic indicators and Federal Reserve actions influence buying behavior. For instance, heightened uncertainty could lead to a surge in demand for gold as a safe haven, while confidence in economic recovery might prompt a shift away from precious metals toward riskier assets.

Experts suggest that gold’s performance this September will serve as a litmus test for how monetary policy decisions and global economic conditions continue to shape investor behavior.

Conclusion: Keeping an Eye on Gold

The interplay between interest rate changes and gold prices remains a critical consideration for investors. As the Federal Reserve prepares for its next meeting, all eyes will be on economic indicators that could sway sentiment and impact market dynamics.

In these uncertain times, staying informed and vigilant is crucial. Understanding market trends, economic indicators, and the potential ramifications of Fed decisions can empower investors to make educated choices about their portfolios.

As you navigate your investment strategy, consider allocating a portion of your resources to gold, especially as experts predict a tumultuous yet potentially rewarding period ahead. Whether you’re a seasoned investor or new to the game, staying informed will always yield dividends.

Call to Action

Are you ready to optimize your investment strategy in light of these emerging trends in gold prices? Keep an eye on economic indicators, market news, and expert analysis to stay ahead in the dynamic world of gold investment. Stay tuned for more updates and insights that can help shape your investment decisions as we approach the next Federal Reserve meeting.

This article explains how the Federal Reserve’s rate cuts affect gold prices. It also includes expert opinions and predictions. If you want to learn more about specific topics, like past trends or technical details, just ask!