Updated on: October 12, 2024 12:59 am GMT

Investors are keenly watching the performance of International Consolidated Airlines Group (IAG), the parent company of British Airways, Iberia, and other airlines, which is experiencing a significant share price rally. After gaining 27% year-to-date, IAG’s shares are now trading at levels not seen since June 2021, igniting optimism about continued growth in the airline sector.

Strong Financial Recovery Post-Pandemic

Despite the ongoing challenges in the airline industry, IAG has shown notable recovery following the Covid-19 pandemic. The company’s current share price is approximately 63% below pre-pandemic levels; however, many analysts suggest that this stock may be undervalued. Here are some indicators of the airline’s recovery:

- Operating Profit: In the first half of 2023, IAG reported an operating profit of €1.3 billion, reflecting a strong ability to capitalize on the resurgence in air travel.

- Debt Reduction: The company’s net debt has been significantly reduced from €9.2 billion to €6.4 billion year-over-year.

- Earnings Per Share (EPS): EPS figures have bounced back to levels seen in 2019, highlighting the recovery of earnings in line with pre-pandemic norms.

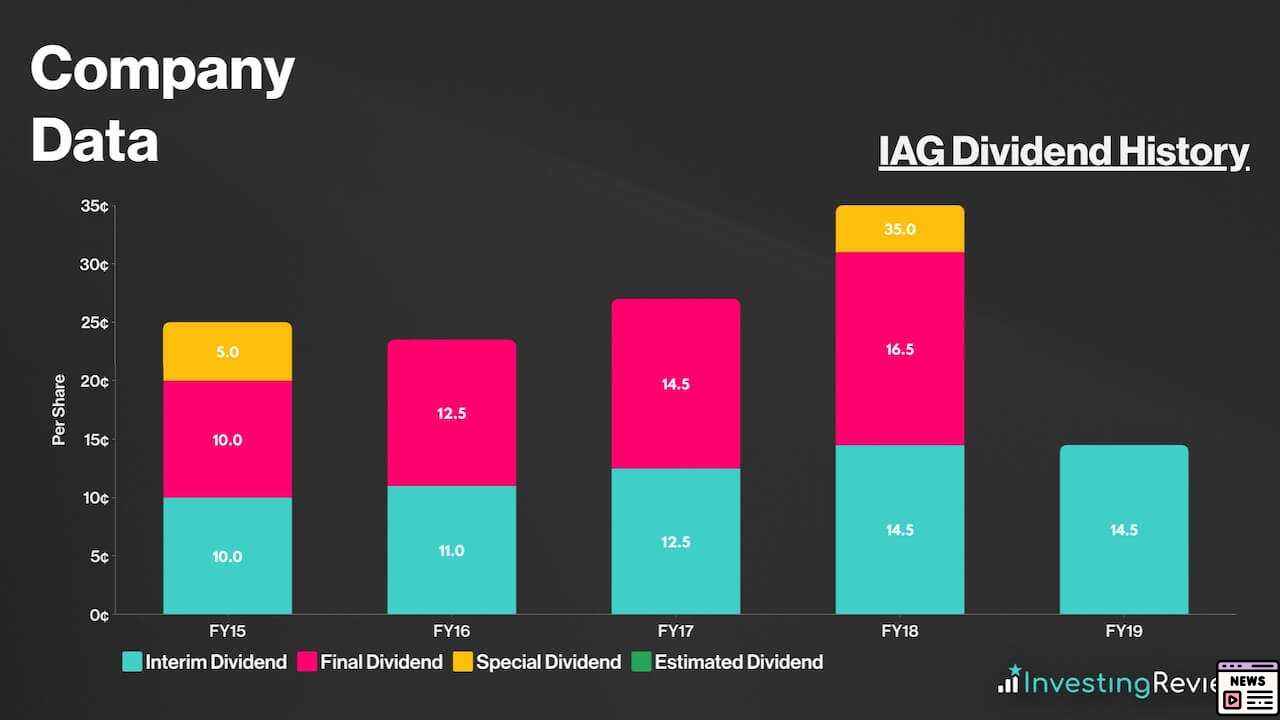

In addition, IAG’s management plans to resume dividend payments starting in September 2024, which analysts see as a confidence booster for shareholders.

Valuation and Market Position

IAG’s current valuation has garnered attention among investors. The company boasts a price-to-earnings (P/E) ratio of around 4, considered relatively low compared to both historical averages and industry peers. Analysts indicate that this low ratio suggests a potential bargain for investors looking for growth opportunities. Here are some items indicating the company’s financial strength:

- Liquidity Position: IAG holds approximately £13.2 billion in cash reserves, providing a cushion against economic headwinds.

- Debt-to-EBITDA Ratio: The company’s net debt to earnings before interest, taxes, depreciation, and amortization (EBITDA) ratio stands at 1.1 times, well below its target of 1.8 times.

Moreover, the bullish sentiment surrounding IAG is reflected in the ratings from multiple analysts, with 10 ‘buy’ ratings and no ‘sell’ ratings currently on the books.

Strategic Initiatives for Growth

IAG is not just relying on recovery; it is actively engaged in strategic initiatives to facilitate long-term growth. A crucial decision was the abandonment of a planned acquisition of Air Europa, demonstrating a commitment to prudent capital allocation. The company is focusing on:

- Fleet Modernization: IAG plans to replace 140 aircraft with more fuel-efficient models over the next five years. This initiative aims to reduce operating costs and improve environmental performance while enhancing the passenger experience.

In addition, capacity planning shows promise. Projections indicate that IAG’s available seat kilometers (ASK)—a measure of capacity—will increase by a compound annual growth rate (CAGR) of 5% through 2028. This expansion aligns with anticipated growth in passenger demand.

Market Outlook and Challenges

Despite a robust recovery and positive market signals, IAG faces several challenges that could impact future performance:

- Economic Headwinds: Increasing fuel prices, geopolitical tensions, and overall economic uncertainties remain significant risks.

- Competition: Competition from low-cost carriers on profitable routes may pressure margins and affect IAG’s market share.

Furthermore, while IAG is enhancing its revenue yield per passenger kilometer from €7.86 in 2019 to €9.36 in 2023, analysts predict that yields may eventually revert to pre-pandemic levels by 2028, primarily due to increased competition.

Investor Sentiment and Strategies

Investor sentiment surrounding IAG remains highly positive. Currently, IG clients show 94% bullishness toward the stock. With consistent growth over recent weeks and a breakout from a continuation triangle pattern on the weekly chart, many investors are eyeing the stock as a potential entry point. Some additional considerations for prospective investors include:

- Share Performance: IAG shares have demonstrated a continuous upward trend, breaking past previous resistance levels such as the 187.65p mark established in May.

For those interested in gaining exposure to IAG or broader airline sector dynamics, investment strategies vary. Options may include:

- Direct Share Investments: Buying shares outright.

- Index Funds/ETFs: Gaining broader exposure to the transportation or aviation sectors.

Before finalizing any investment, potential investors are advised to consult a financial advisor and reassess their overall investment strategy.

IAG has bounced back well since the pandemic, showing good financial results. However, it’s important for investors to be careful because there are still risks in the industry. Economic ups and downs and tough competition could affect how well IAG does. So, anyone thinking about investing should be smart and think things through before making any decisions.