Updated on: October 9, 2024 1:20 am GMT

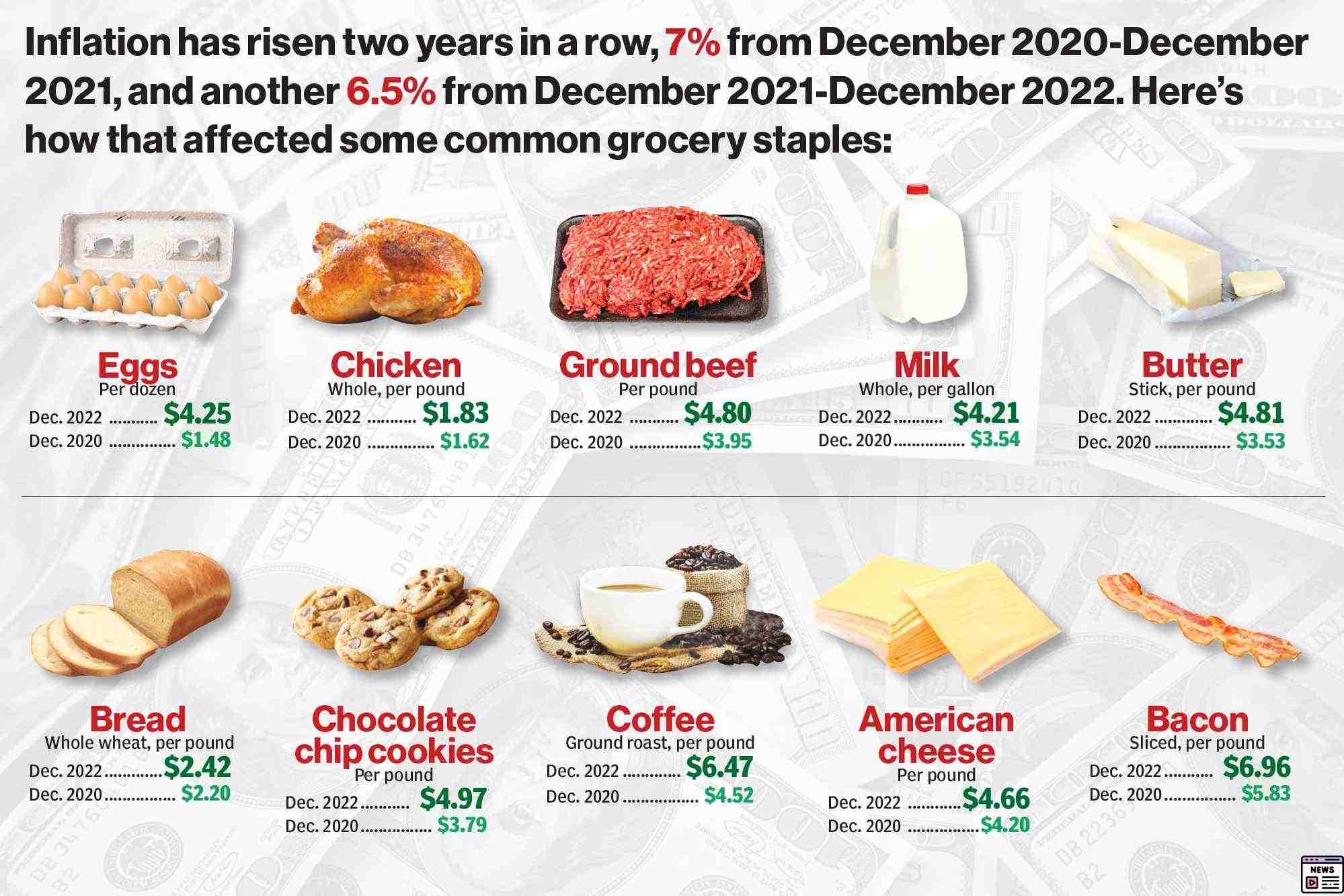

The ongoing discussion about inflation, particularly grocery prices, raises important questions regarding corporate pricing strategies, consumer behavior, and broader economic factors. Many consumers like Ariane Navarro have noted significant increases in their grocery bills, which have outpaced overall inflation. With prices rising roughly 25.6% from February 2020 to July 2023—more than the 21.6% growth in overall inflation—frustration is mounting around the perceived greed of corporations.

Key Factors Contributing to Grocery Inflation:

- Crisis-Driven Supply Chain Disruptions: The COVID-19 pandemic triggered shifts that created substantial logistical challenges. Lockdowns led to panic buying, which, combined with worker shortages at food processing plants, caused supply shortages. Transportation costs spiked amid rising fuel prices, exacerbating the issue.

- Cost Increases Across the Board: Inflationary pressures were amplified by rising costs associated with labor, particularly in lower-wage sectors. Workers in food manufacturing and retail saw wage increases that exceeded those in many other industries, and this fed into higher consumer prices.

- Global Events Impacting Supply: The invasion of Ukraine by Russia severely disrupted global grain and oil supplies, leading to significant price hikes in staples like bread, cooking oil, and cereals. Natural disasters and diseases, such as avian flu and droughts, further strained the supply of various food products.

- Corporate Profits vs. Cost Increases: While companies have cited rising costs as justification for price increases, analyses of profit margins from major grocery item manufacturers indicate that, although profits have fluctuated, the long-term trends show only modest increases. Often, companies have been able to maintain elevated profit margins after an increase, raising suspicions of potential pricing overreach, as seen in a court case involving Kroger.

- Consumer Behavior and Preference Shifts: The pandemic also altered buying habits, with more consumers turning to private-label (store-brand) products that tend to be cheaper yet provide a higher profit margin for retailers, thus influencing overall profits in the sector.

- Persistent Economic Conditions: Even as inflation pressures begin to recede and prices for some grocery items are starting to decline, past profit margins are proving sticky. This means that while costs decrease, retailers may hesitate to lower prices substantially, complicating the inflation landscape.

The Bigger Picture:

While corporate greed and pricing strategies certainly play a role in current food price inflation, they are part of a complex interplay of local and global economic dynamics that include supply chain challenges, geopolitical events, and evolving consumer behavior. The broader consensus suggests that while corporate profit strategies are relevant, they are not solely responsible for the ongoing rise in grocery prices. Instead, they represent one of many forces at play that are shaping the economic realities faced by consumers today.

Policymakers, like Vice President Harris, are paying more attention to how companies set their prices. They promise to fight against price gouging and the power big companies have to raise prices. As the economy improves and hopefully gets steadier, both shoppers and experts are watching closely to see if companies change their ways and if prices go down like we hope.