Updated on: October 11, 2024 4:09 am GMT

As mortgage rates begin to decline, many homeowners and first-time buyers are left wondering if now is the right time to act or if waiting for even better deals could be a costly mistake. With a highly competitive lending environment emerging, the fear of missing out (FOMO) could lead some borrowers into a precarious position.

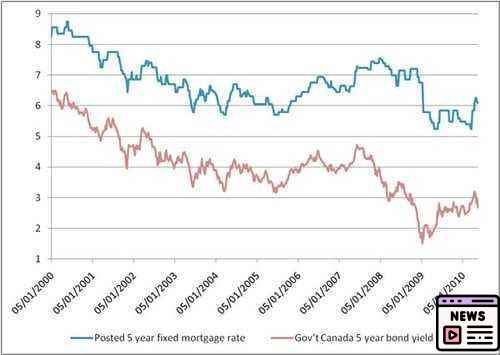

Mortgage Rates Trending Downwards

Falling mortgage rates are bringing a glimmer of hope to those struggling in the current housing market. Recently, major lenders like Nationwide, HSBC, and NatWest announced reductions in their fixed mortgage rates. Notably, TSB made cuts for the second time within just a week, indicating a trend towards more favorable lending conditions. Analysts predict that these reductions may continue, but the complications of FOMO are creating hesitance among potential borrowers.

Current average rates stand at 5.49% for two-year fixed deals and 5.15% for five-year terms, marking the lowest rates seen in over a year. These figures are particularly relevant as approximately 1.6 million existing borrowers have fixed-rate deals expiring this year, creating a landscape where many are looking to lock in new rates before facing significantly higher variable rates.

Understanding the Current Market Conditions

The recent competition among lenders is being driven by several factors. The Bank of England’s decision to cut interest rates in August has contributed to the decrease in mortgage rates. However, many borrowers remain hesitant, waiting for even lower rates before making a decision, which could result in being caught out by rising variable rates.

Concern is growing as homeowners face the potential of shifting to a standard variable rate, which currently averages 7.99%. As rates for new fixed deals are generally lower, procrastination could lead to more expensive monthly repayments.

Borrowers’ Dilemmas

Homeowners like Johnny and Sophie Abbott, who recently moved but could not secure a deal before their previous mortgage expired, exemplify the challenges many face. Despite their best efforts, they felt each option available to them seemed risky. Meanwhile, another homeowner, Gary Rees, expressed relief at the possibility of smaller increases in monthly payments as he anticipates renegotiating his mortgage.

While some borrowers are starting to see some cost relief, not everyone is equally benefiting from the current market conditions. Savers, in contrast, are witnessing diminished interest returns.

The Role of Homebuyers and Remortgagers

Newly purchasing homebuyers are generally receiving more attractive rates compared to those seeking to remortgage. With a stagnant number of buyers, lenders are focusing their efforts on attracting fresh customers. However, this creates a precarious situation for existing homeowners whose deals are expiring soon.

Lenders are offering higher income multiples of up to 5.5 times. David Hollingworth, a broker, remarked that while the lowest rates are not declining dramatically, the overall market remains frenetic as lenders attempt to capture significant market share before the year’s end.

Advising Caution Over FOMO

Financial advisors warn that waiting indefinitely for lower rates poses a high risk. Borrowers should monitor their existing rates closely, especially as their deal expiration nears, to capitalize on potentially favorable conditions. Jo Jingree, director of Mortgage Confidence, emphasizes that some borrowers have successfully secured revised offers that are more beneficial than their previous contracts.

Aaron Strutt of Trinity Financial echoes this sentiment, highlighting the importance of keeping an eye on fluctuating rates and considering available deals as they approach their deadline.

Future Trends and Considerations

Looking ahead, potential rate cuts from the Bank of England could further influence mortgage market dynamics. Analysts expect the situation to evolve in favor of borrowers, especially if funding costs for lenders decrease. However, industry insiders suggest that lenders could benefit from making larger reductions in rates rather than marginal adjustments over extended periods.

In light of the current uncertainty, some strategies can help borrowers navigate the landscape effectively:

- Make Overpayments: If your fixed-rate deal is ongoing, consider making overpayments to reduce the overall debt.

- Switch to Interest-Only: Transitioning to an interest-only mortgage might make monthly payments more manageable, though this would not contribute towards paying off the principal.

- Extend Mortgage Terms: Opt for longer mortgage terms, such as 30 or 40 years, to decrease monthly obligations.

Right now, the housing market is changing a lot and is very competitive. It’s important for new buyers and people wanting to change their mortgage to stay informed and take action. Since mortgage rates seem to be going down, it’s really important to find the right balance between making moves and being careful in this tricky market.