Updated on: October 14, 2024 10:40 am GMT

In 2024, the process of sending money across borders has evolved, making it easier than ever—but not without its costs. If you’re considering using Remitly to transfer funds, understanding the fees is essential for getting the most bang for your buck. This article dives deep into Remitly fees, what you need to know about its various options, and how to maximize your money transfers while minimizing costs.

Understanding Remitly

Remitly is a money transfer service that allows users to send money internationally. It has gained popularity for its quick transactions and competitive rates. With Remitly, you can send money to over 100 countries, promoting financial connectivity across the globe.

The platform offers two main service levels: Economy and Express. Each type of service has different fees and speeds, which can significantly impact your overall experience.

How Remitly Works

Using Remitly is straightforward:

- Choose Transfer Type: Decide between Economy and Express.

- Enter Amount and Recipient Details: Provide the amount you wish to send and the recipient’s information.

- Select Payment Method: Choose how you’ll fund the transfer—options often include bank transfer, debit card, or credit card.

- Confirm and Send: Review fees and transfer speed before confirming your transaction.

What Are the Fees in 2024?

Remitly’s fees vary based on multiple factors. Here’s a breakdown of how these fees are structured for 2024.

Transfer Amount and Destination

Fees can vary widely depending on how much money you are sending and where it is going. Here’s a general idea of the fees associated with different transfer amounts:

| Transfer Amount | Destination | Economy Fee | Express Fee |

|---|---|---|---|

| $100 | Global (selected countries) | $3.99 | $8.99 |

| $500 | Global (selected countries) | $5.99 | $14.99 |

| $1,000 | Global (selected countries) | $9.99 | $19.99 |

Keep in mind that these fees can change based on promotions or adjustments by the company.

Payment Method Fees

Different payment methods also influence the fees:

- Bank Transfers: Generally lower fees; ideal for larger sums.

- Credit/Debit Cards: Typically incur higher fees but offer immediate funding.

- PayPal/Other Wallets: Fees can be comparable to credit cards but vary by transaction.

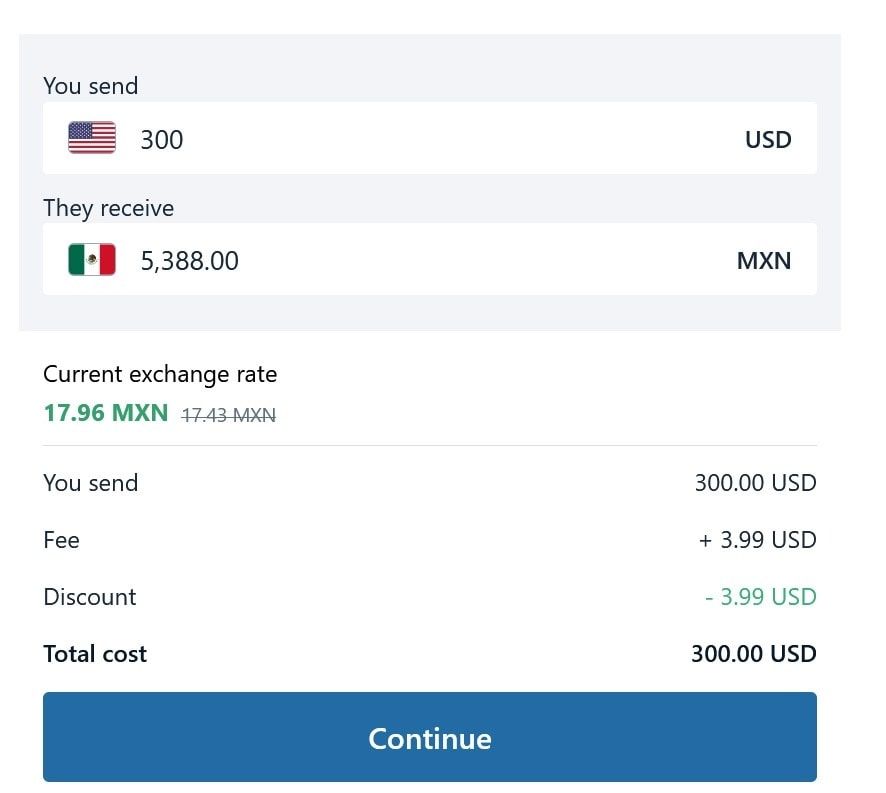

Currency Exchange Rates

One crucial factor to consider is that Remitly sets its own exchange rates. This rate can sometimes differ from the mid-market rate, which can mean additional costs. Always check the exchange rate applied to your transaction to understand the total cost better.

Why Choose Remitly? Pros and Cons

Understanding the pros and cons of using Remitly can help you weigh your options.

Pros of Using Remitly

- Speed of Transfers: Remitly offers both express and economy options, providing flexibility depending on your urgency.

- Wide Reach: With the ability to send money to over 100 countries, Remitly makes international transfers easy.

- User-Friendly Interface: The platform is designed with user experience in mind, making it easy for anyone to navigate.

Cons of Using Remitly

- Fees Can Add Up: Depending on your choice of service and payment method, fees can become costly.

- Exchange Rate Variability: As mentioned, Remitly’s exchange rates may not always be the most favorable.

- Limited Options for Certain Countries: Some destinations may have fewer options for receiving money, which can impact your recipient.

How to Save on Remitly Fees

If you’re looking to save money while using Remitly, here are some tips:

- Choose Economy Over Express Transfers: If timing isn’t critical, select the Economy service to save on fees.

- Send Larger Amounts Less Often: Sending larger sums less frequently can reduce the impact of fixed fees on your transfers.

- Utilize Bank Transfers: These usually incur lower fees compared to credit or debit card payments.

- Keep an Eye on Promotions: Remitly often runs promotional offers that can significantly reduce or waive fees for first-time users.

- Compare Exchange Rates: Before initiating a transfer, use an online currency converter to compare Remitly’s exchange rates with others in the market.

When to Use Remitly

Remitly is best for users who need to send money quickly and affordably to friends or family overseas. It is particularly useful for:

- Families sending remittances to loved ones in another country.

- Individuals making payments to international vendors or services.

- Travelers who need to send money while abroad.

Alternative Services to Consider

While Remitly is an excellent option for many, there are other services worth considering:

- PayPal: Widely accepted and user-friendly, but fees can be higher.

- TransferWise (now Wise): Known for excellent exchange rates, but primarily for bank transfers.

- Venmo or Cash App: While primarily domestic, they offer some international transfer features.

Final Thoughts

Understanding Remitly fees in 2024 is crucial for making informed financial decisions when sending money internationally. By weighing your options and considering factors like transfer type, payment methods, and possible promotions, you can navigate the service while minimizing costs.

Whichever service you choose, always do your research, compare options, and stay informed about fees and transfer times. This way, you can maximize the value of your money transfers and ensure your loved ones have the funds they need promptly.

It’s important to know about transfer services because they can help you manage your money better. This knowledge can also help you stay connected with the people you care about.