Updated on: October 7, 2024 6:18 pm GMT

Overview of Recent Developments at SBI

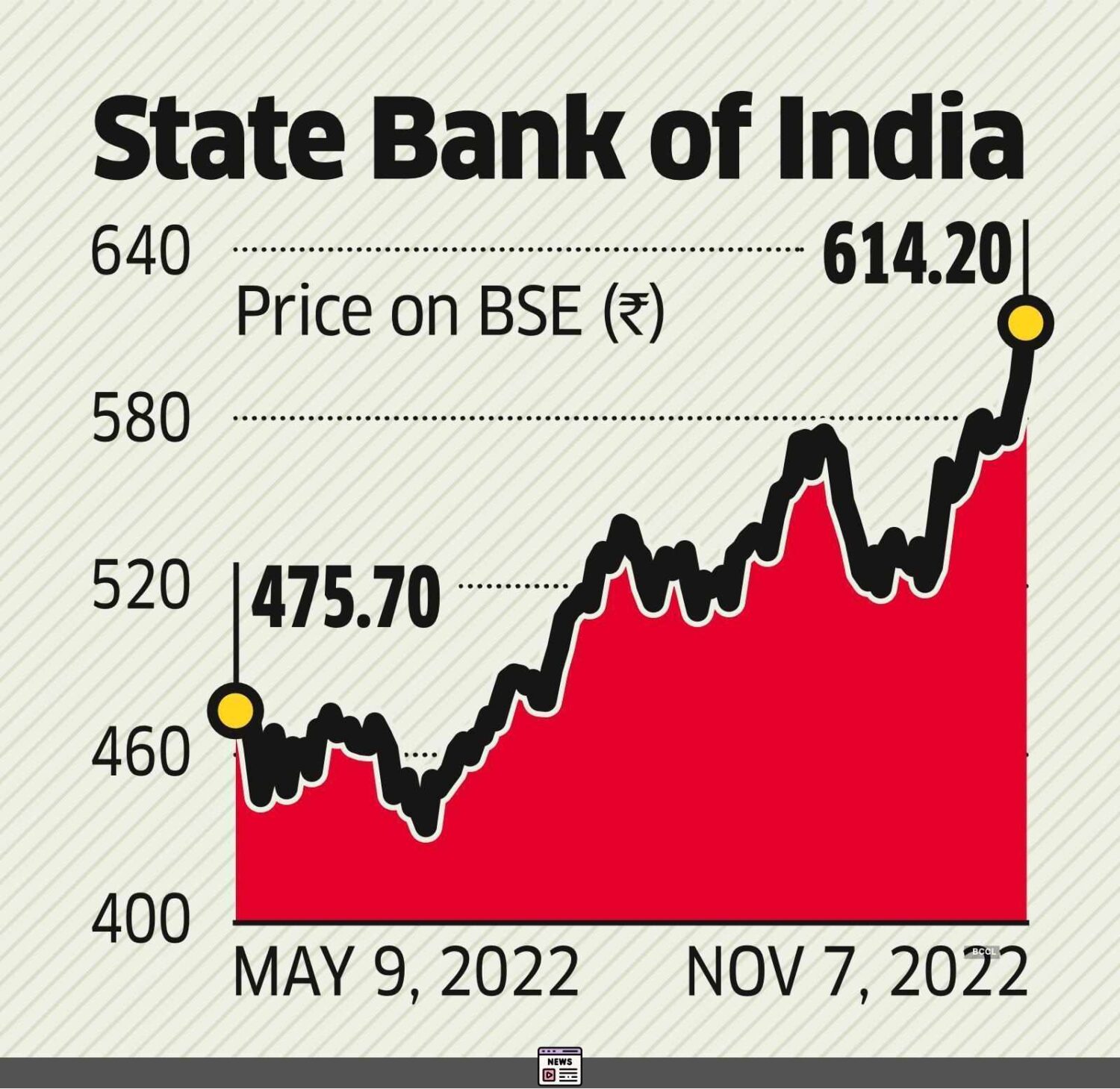

The State Bank of India (SBI), one of the country’s largest financial institutions, recently found itself at the center of attention due to a significant downgrade by Goldman Sachs. As a prominent player in the banking sector, SBI’s stock has experienced notable fluctuations based on changing market dynamics and investment advisories. This article delves into the implications of Goldman Sachs’ ‘Sell’ rating, the factors contributing to this downgrade, and the prospects for SBI moving forward.

Goldman Sachs Downgrades SBI: Key Reasons

In a recent report, Goldman Sachs reduced its rating on SBI from ‘Neutral’ to ‘Sell’, setting a new target price of Rs 742, which is about 12% lower than its previous target of Rs 841. The foreign brokerage outlined several critical factors influencing their decision:

- Peak Profitability: Goldman Sachs believes that SBI’s profitability has reached its peak, suggesting that future growth may face significant headwinds.

- Asset Quality Concerns: The firm indicated that SBI is experiencing deteriorating asset quality, which could lead to increased credit costs.

- Narrowing Returns: The report emphasized a concerning trend regarding the narrowing spread between Return on Equity (ROE) and Cost of Equity (COE). This shift signifies a challenging environment for the bank.

- Marginal Growth Expectations: Goldman Sachs lowered its growth expectations for SBI, anticipating a moderation in lending growth due to a widening gap between loan and deposit rates.

These factors combined create a bleak outlook for SBI, as highlighted by the forex brokerage’s forecast for a decline in EPS (Earnings Per Share) by 3% to 9% for FY25 to FY27.

Understanding the Earnings Pressure

Goldman Sachs indicates that the momentum supporting SBI’s earnings growth has dissipated, implying a potential downturn. The projections reflect a confluence of factors impacting the bank’s financial health:

1. Margins under Pressure

According to Goldman Sachs, SBI and the broader banking sector are grappling with pressures on profit margins. Since the beginning of the year, deposit rates have risen, prompting a squeeze on overall margins:

- Loan-Deposit Ratio: SBI’s Loan-Deposit ratio has peaked, indicating a slowing rate of lending growth as deposits lag behind.

- NIM Compression: The net interest margin (NIM) has begun to compress, showcasing that profit generation from loans is becoming less favorable for the bank. Goldman Sachs projects a decline in NIM by 10 basis points from FY24 to FY27.

2. Slowing Loan Growth

The research highlighted SBI’s challenges in sustaining lending growth. Despite a year-over-year increase of 16% in Q1, the slump in deposit growth at just 8% raises alarms about the sustainability of this traction. The widening gap between lending and deposit growth brings the following concerns:

- Reduced Loan Offerings: As SBI faces diminishing market share in deposits, its ability to offer loans may constrict.

- Focus on Higher-Yielding Loans: The bank’s emphasis on higher-risk unsecured loans may not yield the expected returns, especially if defaults increase.

Market Reactions and Analyst Opinions

The immediate reaction to Goldman Sachs’ downgrade has been profound. SBI’s shares fell sharply, settling at Rs 818.60, reflecting a broader anxiety among investors. While Goldman Sachs has voiced skepticism, not all analysts share the same outlook. For instance, Axis Securities, a rival brokerage, continues to endorse SBI as one of its top picks going forward.

1. A Contrasting Evaluation

Axis highlights SBI’s strong positioning amid India’s evolving economic landscape. They emphasize a few critical points:

- Capital Adequacy: SBI’s solid capital base and prudent management practices ensure that it can weather market fluctuations.

- Focus on Loans Over Investments: The bank’s strategy to shift from investment-focused assets to a more loan-oriented portfolio can aid in maintaining healthy margins.

- Operational Efficiency: Controlling operating expenses will further bolster SBI’s profit prospects, even amidst falling non-interest income.

Despite the Bearish sentiment from Goldman Sachs, analysts like Axis remain cautiously optimistic about SBI’s capability to navigate the current headwinds.

Future Outlook: Navigating Challenges

While the current sentiments around SBI remain mixed, it is essential to consider the bank’s strategic responses to the highlighted challenges.

1. Adapting to Market Conditions

SBI has launched several initiatives aiming to enhance its competitive edge in an increasingly challenging environment:

- Deposit-Growth Strategies: The bank is prioritizing the growth of its deposits by enhancing customer engagement and offering attractive deposit schemes.

- Asset Quality Management: To counter the concerns regarding asset quality, SBI is monitoring its MSME (Micro, Small, and Medium Enterprises), agricultural, and unsecured loan portfolios closely.

- Leveraging Technology: Embracing fintech and digital platforms will allow SBI to streamline processes and improve customer service.

2. Monitoring the Economic Landscape

The broader economic context in India plays a pivotal role in shaping outcomes for institutions like SBI. Analysts expect several trends to influence the banking landscape:

- GDP Growth: If India’s economic activity continues to expand, banks, including SBI, might benefit from increased lending opportunities.

- Interest Rate Sentiment: Future monetary policy decisions will impact loan demand, particularly in the unsecured lending space.

The interplay between these factors will be crucial in determining SBI’s trajectory over the next few years.

Conclusion

The downgrade of SBI by Goldman Sachs marks a critical moment for investors and stakeholders in the banking sector. While significant concerns exist regarding the bank’s profitability and growth trajectory, varying opinions among analysts highlight the complexity of the current market.

As SBI faces new challenges and uses its strengths, it’s important for investors to keep themselves updated and ready to act. Watching how the company manages itself and how the economy changes will help everyone deal with the unknowns in the future. Whether this situation is seen as a chance to grow or a danger really depends on how the market feels and how well SBI can adapt to changes.