Updated on: October 7, 2024 6:26 am GMT

Understanding the Political Landscape Surrounding US Steel’s Proposed Merger

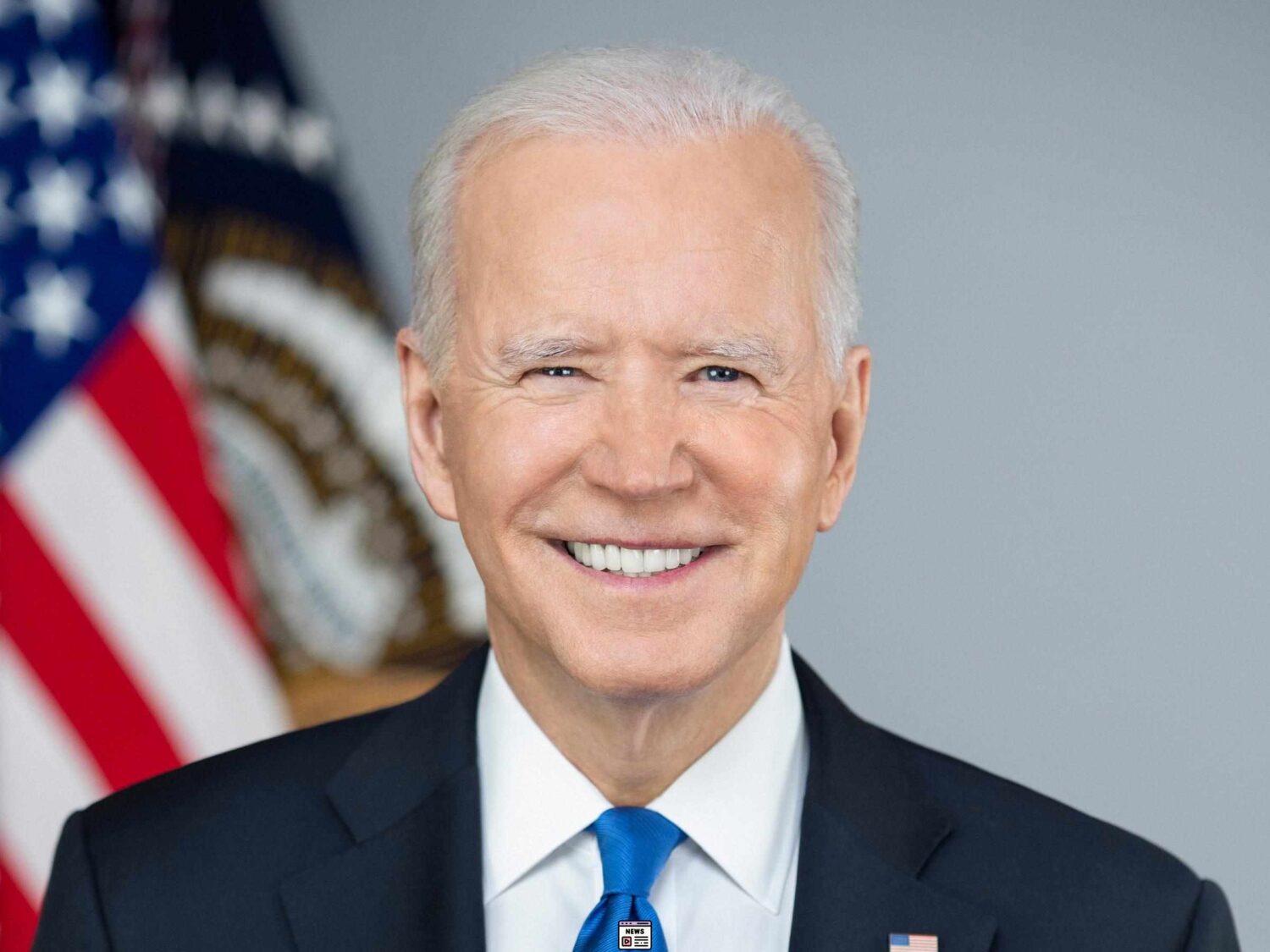

The American steel industry, once a titan of the economy, is currently navigating choppy waters as the proposed merger between US Steel and Japan’s Nippon Steel stirs controversy and political maneuvering. With influential figures like President Biden, Vice President Kamala Harris, and former President Donald Trump opposing the deal, the stakes are high for both companies and their workers. This article explores the implications of the merger, the motivations behind the opposition, and the potential outcomes for US Steel and the communities dependent on it.

The Proposed Merger: A Complex Landscape

At the heart of the debate is the merger where Nippon Steel has proposed acquiring US Steel for $2.7 billion. This acquisition has raised concerns across the political spectrum about the future of American jobs and the integrity of U.S. manufacturing. With historical roots tracing back to 1901, US Steel was once emblematic of American industrial prowess, making this merger not just a corporate decision but a national sentiment about American-made goods.

Political Opposition: A Bipartisan Front

Despite differing on numerous issues, Biden, Harris, and Trump are aligned in their opposition to the sale. Their collective stance exemplifies the heightened sensitivity around foreign ownership of a once-great American company. Each leader has expressed fears that a merger could jeopardize thousands of good-paying union jobs and undermine the U.S. steel industry’s competitive edge.

Vice President Harris passionately spoke in Pittsburgh during a Labor Day rally, saying, “US Steel is a historic American company, and it is vital for our nation to maintain strong American steel companies.” This sentiment echoes a broader concern that the merger could symbolize a loss of American economic strength, especially in critical battleground states like Pennsylvania where steel manufacturing is still a significant part of the economy.

Labor Concerns: The Unions Weigh In

A major player in this narrative is the United Steelworkers (USW), which has vocally opposed the merger. The union argues that US Steel’s threats to close mills and shift operations if the merger is not approved are not only “baseless” but are indicative of poor management. The USW’s response reflects a deep-seated apprehension about the internationalization of jobs and the company’s loyalty to its unionized workforce.

As the USW is negotiating from a position of political power, they are leveraging their influence to extract stronger commitments from both Nippon Steel and US Steel. Analysts posit that if the union were to support the deal, it could alleviate some of the political resistance tied to the merger and allow for smoother regulatory approval.

Analyzing the Stakes: What’s at Risk?

The potential failure of the merger could have far-reaching implications. US Steel has threatened to pivot away from its blast furnace facilities, which employ unionized workers, if the deal falls through. The company’s commitment to an investment of $2.7 billion from Nippon Steel hinges on the successful transaction, which presents an unsettling picture for employees dependent on these jobs.

The Economic Reality: A Changing Industry

As the dynamics of the global steel market shift, US Steel faces significant challenges. The rise of foreign competitors, particularly those with advanced electric furnace technology, has made traditional steelmaking processes less viable. This context underlines US Steel’s argument that the merger is essential for revitalizing its operations and securing jobs in an increasingly competitive market.

Many experts believe that the merger presents a unique opportunity not just for US Steel but for the broader American steel industry, which has been struggling to maintain its global standing. Nippon’s promised investments could greatly enhance the competitiveness of US Steel’s production capabilities against global giants, particularly from countries like China.

The Road Ahead: What Happens Next?

While the merger’s future hangs in the balance between political, economic, and labor considerations, here’s what we can expect in the near term:

Continued Political Scrutiny

The merger will undoubtedly remain a point of contention in the political arena as the 2024 election cycle approaches. Politicians will likely continue to posture against any implications of foreign ownership of essential American industries. This environment creates a challenging regulatory landscape for Nippon Steel as they seek the necessary approvals.

Potential Union Negotiations

If negotiations between the union and US Steel progress positively, it could lead to a re-evaluation of their opposition. A compromise that ensures job security and fair wages for workers could pave the way for a more favorable regulatory environment. This shift would also reshape how the deal is perceived in the court of public opinion, making it much more palatable for political leaders to support.

Corporate Strategies Moving Forward

Both companies are likely to refine their strategies to win over stakeholders. US Steel may need to provide more granular details about how operations will continue without sacrificing employment. Nippon Steel will also have to be transparent about its intentions for maintaining and investing in US manufacturing jobs rather than shifting focus solely to non-union facilities.

Ultimately, the road to the merger’s final conclusion may take time. Political dynamics, labor negotiations, and changing market conditions will all play pivotal roles in determining whether this deal reaches fruition, and if successful, how it will shape the future of steel manufacturing in the United States.

Conclusion: Bridging the Divide

In this complicated story about company mergers and political issues, the future of US Steel and its workers is in a tough spot. Many people from different political parties are against Nippon Steel buying US Steel because they care about American jobs and want to protect local businesses. As important players work through this tricky situation, the future of US Steel and the jobs of thousands of people depend on finding a solution that everyone can agree on. Should they keep jobs and upgrade the company with help from a foreign investor, or is it better to focus on solutions that support American workers? As these conversations keep going, we’ll have to wait and see what happens to this famous American steel company.