Updated on: October 7, 2024 8:11 pm GMT

The S&P 500 index dropped 1.5% on Friday, August 30, 2023, marking a significant downturn as it heads toward its worst week since March 2023. This decline follows the release of a disappointing jobs report that revealed fewer job additions than anticipated, prompting investors to sell off technology stocks and reassess their outlook on the economy. The Nasdaq Composite experienced a larger fall, shedding 2.3%, while the Dow Jones Industrial Average decreased by 345 points, or 0.8%.

Weaker-Than-Expected Jobs Report

According to the Bureau of Labor Statistics, the U.S. economy added only 142,000 jobs in August, substantially below the 161,000 expected by economists surveyed by Dow Jones. While the unemployment rate dipped to 4.2%, this slight improvement has done little to assuage concerns about a softening labor market. Compounding these worries, downward revisions for previous months indicated that fewer jobs were created than initially reported, with a revised total decrease of 86,000 jobs for June and July.

Sonu Varghese, a global macro strategist at Carson Group, commented on the report, stating that it highlights growing risks within the labor market. He indicated that prevailing weak job data could necessitate the Federal Reserve stepping in to mitigate these risks. “The report seals the deal for a September rate cut,” he added, pointing to the pressing question of whether the Fed will opt for a larger cut of 50 basis points or stick with a more measured reduction.

Markets React to Economic Signals

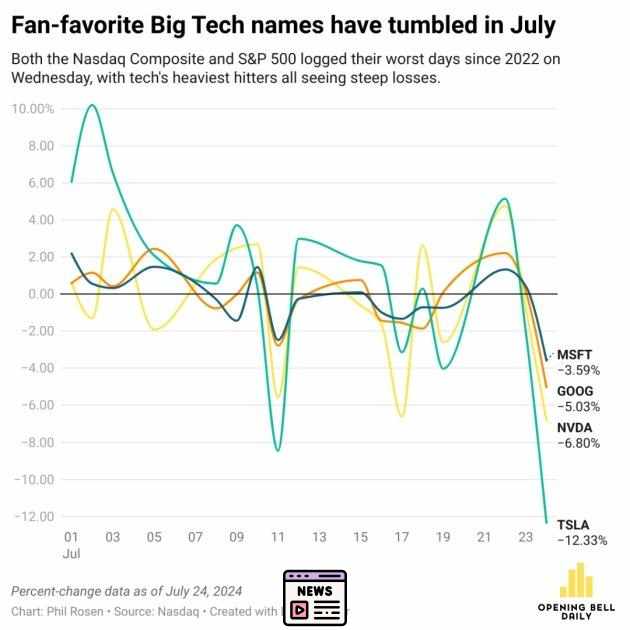

The disappointing jobs data, combined with ongoing fears about economic stability, has spurred a wave of selling across equity markets. Investors have shown a particular aversion to technology stocks, with major firms like Amazon, Alphabet, and Microsoft experiencing declines of more than 3% as risk aversion grew. The VanEck Semiconductor ETF, which encompasses major players in the chip sector, fell 4.6% and is on track for its worst weekly performance since March 2020.

Broadcom, a notable semiconductor company, saw its stock plunge 10% following its disappointing revenue forecast. Analysts had anticipated higher earnings, which put extra pressure on chip-related stocks this week. Nvidia and Advanced Micro Devices also suffered, each declining more than 5%. This trend reflects a broader sentiment in the market, where volatility has become the norm amidst rising concerns about the economy’s performance.

Federal Reserve’s Equilibrium

In light of the mixed jobs data, discussions surrounding potential interest rate cuts have intensified. Many financial analysts predict that the Federal Reserve may reduce rates by at least 25 basis points at the upcoming meeting in September. However, there is a notable divergence in opinions, with some investors betting on a more aggressive 50 basis point cut, based on the latest figures from the CME Group FedWatch tool.

John Williams, president of the New York Fed, endorsed the notion of rate cuts during remarks at the Council on Foreign Relations, asserting that adjustments to the federal funds rate are necessary to align with the Fed’s dual mandate goals. This statement has further fueled speculation on the Fed’s next moves and its implications for market performance.

Investment Trends Amidst Economic Downturn

As investors navigate this turbulent environment, they are reallocating their portfolios in response to the changing economic landscape. The prevailing market atmosphere showcases a growing preference for more stable investments, as risk assets like technology stocks come under scrutiny. Economic indicators that might have previously inspired confidence are now seen through a more cautious lens.

The S&P 500 is on track for a week-over-week decline of 4%, marking its most significant drop of the year. The Nasdaq is also heading for its worst week since April, down approximately 5.6%. Meanwhile, the Dow is recording a substantial 2.8% weekly loss. This pattern signifies a broader trend within financial markets, as traders grapple with the fallout from the labor report.

Corporate Earnings and Future Projections

Despite the overall downturn, some companies have managed to perform positively. For instance, Bowlero, a bowling alley chain, saw its stock rise over 10% after exceeding revenue expectations for its fiscal fourth quarter. Similarly, UiPath—a software company—reported better-than-anticipated second-quarter results, which prompted a stock rise exceeding 9%.

However, this positive news has been overshadowed by the broader challenges facing the tech sector and the semiconductor industry. Broadcom’s decline illustrates the repercussions of weaker-than-expected sales forecasts within this vital segment of the economy.

Conclusion: Navigating Uncertain Economic Waters

The economic landscape is currently fraught with uncertainty as investors analyze the implications of a deteriorating labor market and the Federal Reserve’s potential policy adjustments. With upcoming rate-setting meetings likely to influence market sentiment, careful consideration of investment strategies remains critical. As equities struggle to maintain upward momentum, traders will continue to monitor economic indicators to gauge the best paths forward.

Investors should pay close attention to the ups and downs in the market. It’s important to look at the latest information and think about how the overall economy might change in the next few weeks and months.