Updated on: October 8, 2024 7:37 am GMT

Over one million state pensioners are set to benefit from new initiatives from the Department for Work and Pensions (DWP), providing potential income boosts totaling up to £6,640 this year. These benefits include increased support through Pension Credit, Winter Fuel Payments, discounted council tax, and a reduction in TV licensing fees. With the rising cost of living impacting many, these additional benefits could offer much-needed financial relief.

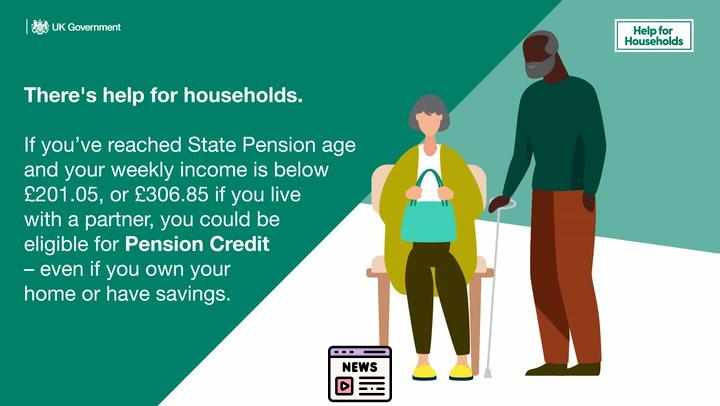

Pension Credit: A Vital Resource for State Pensioners

Pension Credit, a means-tested benefit designed to support older individuals living on lower incomes, stands at the center of this initiative. Currently, eligible pensioners could receive up to £3,900 annually through Pension Credit alone. Notably, this benefit not only increases income but also unlocks access to additional perks.

For pensioners who apply for Pension Credit, savings can be significant. Those who qualify can receive a discount on their TV licence fee, resulting in potential savings of £169 per year. Furthermore, those who qualify might also receive a £300 Winter Fuel Payment to assist with heating costs during the colder months.

The DWP emphasizes the importance of signing up for Pension Credit, especially as many older people may not realize their eligibility. Recent statistics indicate that approximately 880,000 eligible pensioners are not currently claiming this vital benefit, highlighting a significant awareness gap that the DWP is working to address through outreach efforts.

Additional Benefits for Eligible Pensioners

Beyond Pension Credit, this financial support package includes various forms of assistance aimed at furthering economic stability for older citizens. Among these are council tax reductions, which can provide support of up to 91.5% of the council tax bill for working-age individuals and up to 100% for pensioners. The DWP reports that the average council tax support for eligible pensioners is around £2,171 per year.

- Temporary TV licence discount: Potential to reduce the fee to £0.

- Winter Fuel Payment: Up to £300 to help with heating bills.

- Council Tax Support: Average reduction of £2,171 for eligible pensioners.

This combination of benefits aims to provide substantial financial assistance, especially significant in light of the ongoing cost of living crisis that has been pressing on many households across the UK.

The Importance of the £10 Christmas Bonus

An additional financial perk for eligible pensioners includes the £10 Christmas Bonus. This one-off, tax-free payment is available to individuals receiving the State Pension and other select benefits such as Personal Independence Payment (PIP) and Attendance Allowance. The bonus is automatically issued during the first full week of December, requiring no application from recipients.

Historically, this Christmas Bonus was introduced in 1972, and although it has not seen an increase in its payout amount, it serves as a small yet meaningful financial boost during the holiday season. Eligibility extends to those who were present in the UK during the qualifying week, which is expected to run from December 2 to 8 this year.

Encouraging Claims and Awareness

The DWP is actively working to improve awareness about these benefits, particularly as many older adults may remain unaware of their full eligibility. Research shows substantial numbers of pensioners living alone, who could greatly benefit from applying for Pension Credit and related support measures. For example, a recent study indicated that about 3.3 million individuals aged 65 and over lived alone in England and Wales, emphasizing the need for targeted outreach and support services.

Pension Credit consists of two components: Guarantee Credit and Savings Credit. Guarantee Credit supplements a pensioner’s income to a minimum threshold, which currently stands at £218.15 per week for singles and £332.95 for couples. Those who qualify for Savings Credit may receive additional support based on their savings and income status.

To determine eligibility, pensioners are encouraged to utilize the online Pension Credit calculator provided by the Government. This straightforward tool can assess potential benefits and facilitate smoother applications. Moreover, individuals can directly contact the Pension Credit helpline, ensuring easy access to resources and financial education.

Final Thoughts on Pension Credit and Related Benefits

A significant proportion of the older population currently lacks vital financial support available to them, illustrating the pressing need for the DWP’s awareness campaigns. The aim is not only to inform eligible individuals about the benefits they may claim but also to combat misperceptions that prevent many from applying. In particular, many pensioners mistakenly believe that having savings disqualifies them from receiving Pension Credit, which is not the case for those who meet other eligibility criteria.

Financial support systems, like Pension Credit, are really important for helping older people in our society. As seniors manage their money, it’s essential for them to know about the benefits that can help them. These benefits can make everyday life a little easier, especially when money is tight.